As we live through a transformational shift to an increasingly digital and automated economy, we must overcome the reality that economic growth remains unevenly distributed throughout the world. While millions have enjoyed new levels of prosperity, many still live in poverty.

Through frameworks such as the UN Sustainable Development Goals (SDGs), efforts are underway to harness the resources, the expertise, and the capital of the public, private, and cause sectors in a way that accelerates society’s work to address extreme poverty and equitably distribute growth.

Achieving the vision of the SDGs by 2030 requires a level of resources that no government, corporation, or organization alone can provide. Only the transformative influence of markets can lift nearly half the planet out of poverty within a decade. The influence of markets comes when all actors engage in a coordinated manner to not only produce goods and services that meet a human demand but also provide social and economic opportunities to meet a human need.

The emerging paradigm of sustainability is quickly evolving into a market framework which we term a sustainable market. A sustainable market is one made up of actors organized around the vision of building long-term value for society through an integration of natural, social, human, and financial capital into the creation of goods and services at a cost affordable to the general public. This definition allows us to identify where these markets are forming and where others already exist.

Texas Wind Power: A Sustainable Market

An example of a sustainable market is the wind power industry in Texas. The State of Texas is by far the leading producer of wind energy in the United States and has installed more wind power capacity than all but five countries in the world.

Wind power checks all the boxes for a sustainable market as it provides cheaper electric rates to consumers, protects the environment, and is one of the fastest growing occupations in communities across the country.

The critical driver behind the rapid growth in the Texas wind power industry is the close coordination among all the actors in the market. Texas’ public sector (policymakers and regulators) created a legal framework that allowed the private sector to quickly scale its investments. The cause sector (such as environmental NGOs) has served as partners and advocates throughout the market’s development, accelerating consumer demand.

Understanding Sustainable Markets

To better understand how sustainable markets form and expand, Handshake leveraged media analytics and machine learning to examine the global conversation on the topic. The reason we measured and analyzed conversations is because sustainable markets depend on reputational “signaling” as well as price “signaling.” They cannot exist without the public-facing narrative that establishes that they are sustainable.

In other words, for a product or service to be known as sustainable, it must be communicated as such. For example, no one purchases electricity from wind power in Texas without identifying the environmental benefits, investments in communities, and cost savings to consumers as compared to power generated by fossil fuels.

By mapping where the current conversations are around sustainable markets, we can identify where signaling is occurring that correlates with the emergence of a sustainable market.

The Network Map of Today’s Sustainable Market Conversations

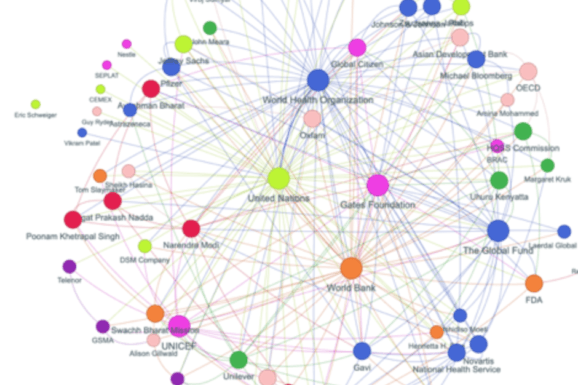

Each of the circles in the below map represent a given story in the global conversation around the development of sustainable markets.[1] Using an analysis of key words and terms, Handshake classified each story by market actor based on their prominence in each article.

[1] An analysis of 1,195 media stories between February and December 2018

- Blue: Public sector – 50% of the conversation

- Orange: Cause sector – 20% of the conversation

- Red: Private sector – 15% of the conversation

- Green: Private sector finance – 15% of the conversation

Top Takeaway

The most important takeaway from this map is that the actors engaged in creating sustainable markets are not consistently collaborating in a manner that will quickly and efficiently spread their adoption.

The good news is that there is some overlap between the main actors in the network. The cause sector – often the subject matter experts in sustainable markets – appears to be in the middle of the conversation. Private sector finance (green dots) is often the source of financial capital and appears to be somewhat integrated into the conversation, but to a much smaller as the cause sector.

However, the troubling aspect of this map is that the private (red dots) and public (blue dots) sectors are not closely connected. This means that, rather than actively collaborating as is the case in the Texas wind power market, the two most influential actors in the development of sustainable markets often are disconnected from each other and not consistently collaborating.

If the work of the public and private sectors was more tied together, we would see a map that has much greater overlap and integration, rather than solid blocks of color occupying separate quadrants. This overlap would show that different sectors are entering the same conversations, and thus collaborating.

In reality, this means companies like Ikea, Unilever, and Johnson & Johnson too often are going it alone and excessively relying on their global market power to create sustainable markets where none exist. In addition, you have public sector experts creating policy frameworks for sustainable markets but not necessarily with the specific needs and interests of private sector actors in mind. As a result, the public sector feels justified in believing it is not finding needed support from the private sector, which, in turn, sometimes feels it must work exceedingly hard to create markets because there is not a readily available policy framework to follow.

This disconnect means that it is taking too long to create sustainable markets that are of sufficient size, scale, and price efficiency to overtake existing markets for less sustainable products. Furthermore, there are a number of potentially promising markets – namely sustainable cotton, electric vehicles, and responsibly sourced minerals – unable to reach their full capacity for delivery of a superior product to consumers.